1031 exchange calculator

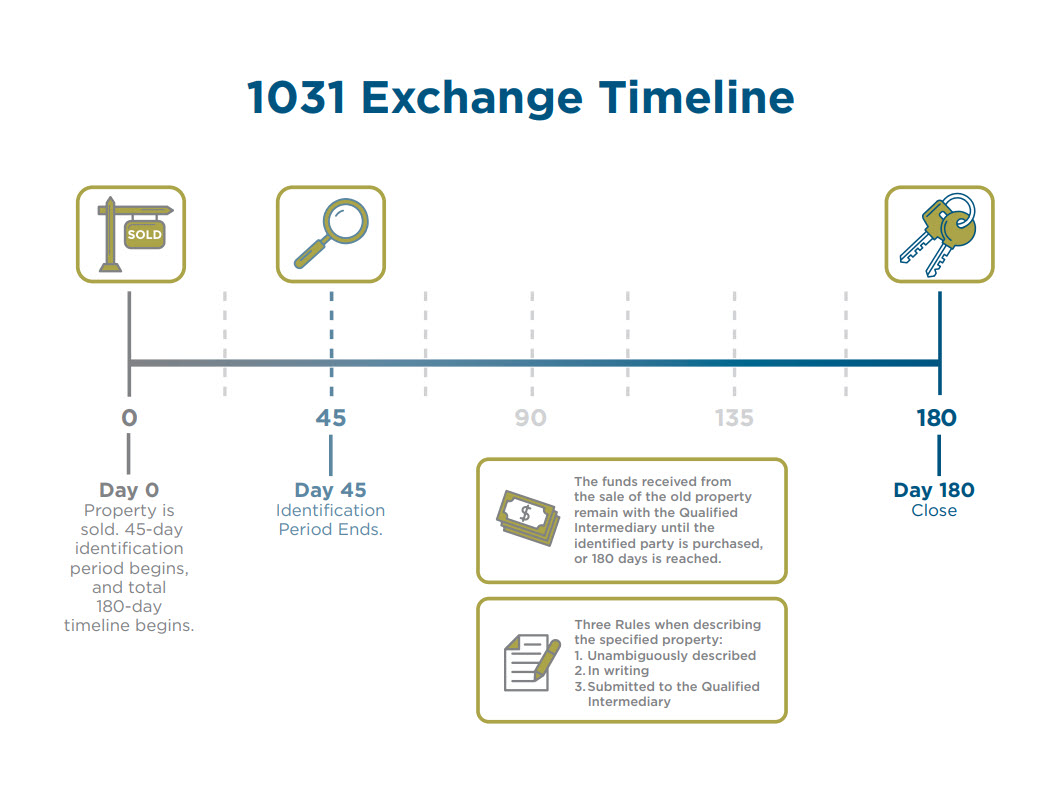

Please enter relinquished sale date below and click Calculate 45-day Identification Period ends at midnight of. The time periods for the 45-day Identification Period and the 180-day Exchange Period are very strict and cannot be extended even if the 45th day or 180th day falls on a Saturday Sunday or.

1031 Exchange Explained What Is A 1031 Exchange

If the investor does not move forward with an exchange then the transfer of property is a sale subject to taxation.

. Crefcoas 1031 exchange calculator is used to help estimate the deferment realized by performing a 1031 exchange rather than selling the property and incurring a taxable event. You have 45 days after you close escrow to identify potential replacement properties and 180 total days after the close of escrow to close on your. An investor that holds property longer than 1.

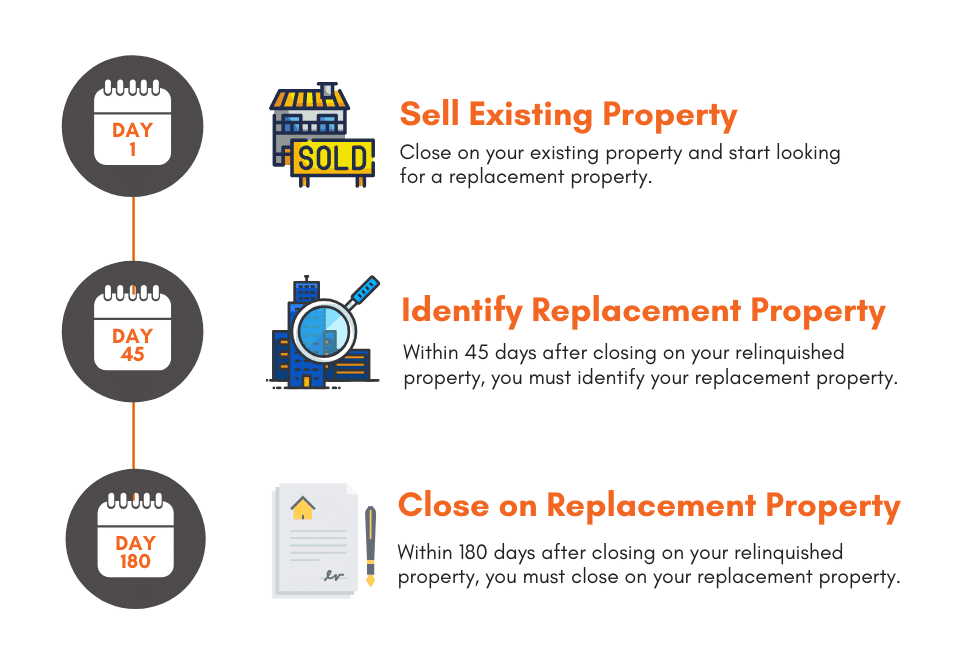

This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. Use this calculator to help you determine the deadlines for the 45-Day Identification Period and the 180. The IRS places two timing restrictions on any 1031 exchange.

You must formally identify potential replacement properties within 45 calendar days from sale. To pay no tax when executing a 1031 Exchange you must purchase at least as. Use our exchange date calculator tool to determine your identification and closing deadlines to help you plan your 1031 exchange.

1031 exchange calculator- Our 1031 exchange calculator will help you to determine the tax deferment you will realize by performing a 1031 exchange rather than a taxable sale. If youre planning to perform a 1031 tax exchange this calculator will help you determine both the 45 day and 180 day deadlines. 1031 Exchange Date Calculator.

180-day Period Ends on. The projections or other information generated by the 1031 Exchange Analysis Calculator regarding the likelihood of various investment outcomes are hypothetical in nature. 1031 Exchange Deadline Calculator.

To pay no tax when executing a 1031 Exchange you must purchase at least as. Well be happy to help you with calculating your 1031 Exchange please give us a call 215-489-3800. A 1031 Exchange requires meeting very strict deadlines for successful completion.

In performing a 1031 exchange one must speak to and. This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. The maximum exchange period from the closing date of your sale of the relinquished property to the purchase or your replacement property is 180 calendar days.

And the property or. Enter the following information and our calculator will provide you an idea of how a 1031.

1031 Exchange Calculator Ramen Retirement

1031 Exchange Savings Calculator

What Is A 1031 Exchange Asset Preservation Inc

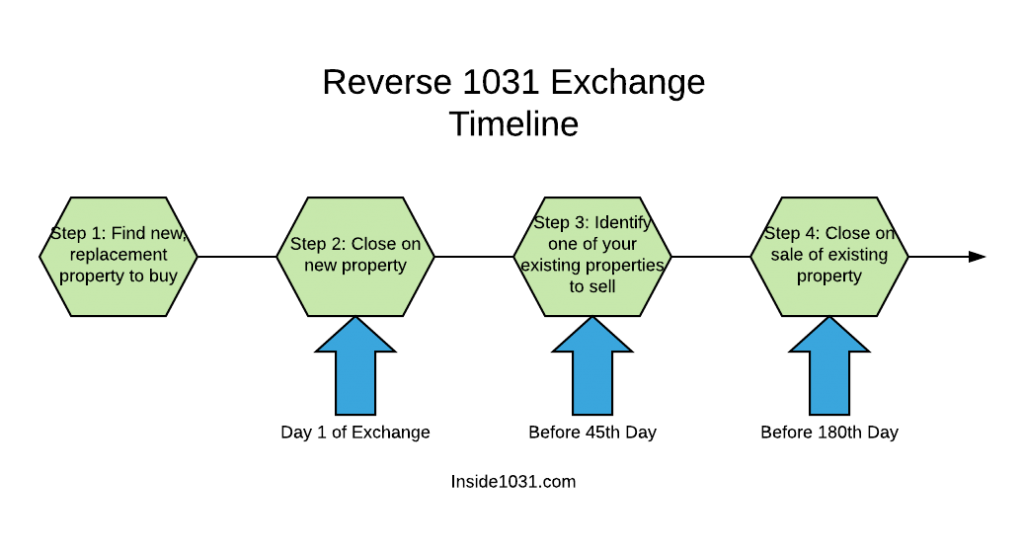

1031 Exchange Timeline Overview And Considerations Accruit

What Is A Starker Exchange 1031 Exchange Experts Equity Advantage

45 180 Day Exchange Calculator 1031 Crowdfunding

Learn The True Time Frame For A 1031 Exchange

1031 Exchange Overview And Analysis Tool Updated Apr 2022 Adventures In Cre

1031 Exchange Experts Equity Advantage 800 735 1031

1031 Exchange What Is It And How Does It Work Plum Lending

Deadline Calculator For 1031 Exchanges

![]()

1031 Exchange How It Can Work For Your Properties

1031 Exchange Overview And Analysis Tool Updated Apr 2022 Adventures In Cre

1031 Exchange Calculator Estimate Tax Savings Reinvestment

1031 Exchange Rules Real Estate Transition Solutions

1031 Exchange Capital Gains Tax Calculator Midland 1031

1031 Exchange Calculator With Answers To 16 Faqs Internal Revenue Code Simplified